Insurance Tips

Business, Auto, and Home Insurance Tips from our team.

A Strategy for Saving Money- Swap Mortgage Life Insurance for Term Life Insurance

Comparing the two, becomes clear that Term Life Insurance is a far superior product than Mortgage Life Insurance.

Climate Change & the effects of home insurance

In Ontario, climate change significantly impacts home insurance, escalating premiums as insurers integrate AI to enhance risk assessment and mitigation efforts.

Critical Illness Insurance: the Forgotten One

Critical illness insurance offers vital financial protection against severe health conditions, providing lump-sum payouts for covered illnesses to cover expenses and maintain stability during challenging times.

Tackling Insurance Myths

Insurance safeguards against financial hardships from unexpected events, but myths and misunderstandings can confuse decisions; this blog aims to clarify common misconceptions.

Health Spending Accounts- The Alternative to Traditional Workplace Health Benefits?

Small business owners face a tough choice on whether to purchase health benefits for employees in order to attract and retain talent, or risk the potential negative impact on recruitment, retention, and overall employee satisfaction.

What Is An Affinity Group and Do I Qualify?

If you are insured with Zehr Insurance, there’s an ever-increasing chance that you do qualify for Group Insurance offerings!

Utmost Good Faith – Being Honest and Upfront With Your Broker

There are many items in an insurance contract, but the main one that determines if you claim is paid or not is Utmost Good Faith.

What is the importance of Insurance?

“Why do I need insurance?”, “Why do I need that coverage?”, “Why are the premiums so high?”, “I have had insurance for a long time and have never had to used it, why do I need to keep paying for it?!”

Is your RV properly protected?

RV insurance provides financial protection from damage or loss to your motorhome – trailer due to an accident, weather or other damaging events.

Are you planning on a winter vacation?

If you are a homeowner, there are a number of different things you can do to ensure that your home insurance will be valid and cover you in the event you have an issue while you are away.

Theft Claims

How many of us run in to grab something and maybe forget to lock the car and run into the house? Have been to a store 100 times and are only going to be 50-100 feet from the car? Who considers their car or truck to be their office on wheels?

Key Factors to Consider When Purchasing Home Insurance

You have bought a home and now it is time to look for home insurance. What do you need, how much will it cost, and what coverages should you have?

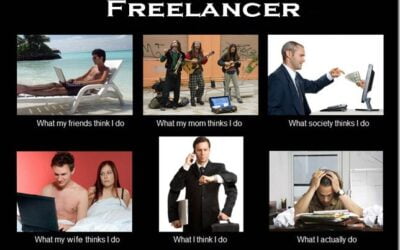

Freelance Insurance

If you’re a freelancer you work hard and your insurance policy should do the same!

Cyber Risk and Prevention

Current cyber risks against small business and the steps that should be taken to prevent these risks.

Tips for Preventing Vehicle Theft

Quick tips we often neglect, that go long way protecting your vehicle and its contents.

A Brief History of Insurance

Primer Home Insurance and Auto Insurance is something most people will purchase at some time. Often considered a significant part of someone’s budget and financial plan, it’s something many people are familiar with. Although it’s not unusual for customers to consider...

Is your auto insurance costing too much?

The current Ontario auto insurance product is broken. It does not need another band aid effort to fix it, it needs a complete overhaul!

Cyber Risk Protection – Cost of Notification

How a cyber insurance policy can provide coverage for the cost of notification to those impacted by a data breach.