Written by Jeremy Matheson & Matthew Fleming

Zehr Insurance Brokers Ltd.

“That ungrateful little yuppie larvae.”

As a young Ghostbuster fan, I never really cared why the Ghostbusters were driving around in that beat up Ecto-1, playing children’s birthday parties and bar mitzvahs. The last I had seen them they were celebrating the destruction of Stay Puft on Fifth Avenue and were heroes. Fast forward thirty years and now an insurance professional, I have a better understanding of the repercussions from the climax of Ghostbusters (1984). But, could the challenges faced by the team have been averted if the squad used a Broker and had the correct insurance coverage in place? Could Ghostbusters 2 have had a completely different story?

For the purposes of this blog, I have removed The Real Ghostbusters and Extreme Ghostbusters from the continuity, along with any of the print series’ and other media. Let’s focus on ‘Ghostbusters (1984)’, the happenings and events and what led to the gang going out of business. To make the story more local and applicable to the Ontario Automobile Insurance policy, we will also assume that the Ghostbusters are operating out of the largest urban centre in Ontario, somewhere in the Greater Toronto Area.

We will explore two types of insurance that may have helped keep them from going out of business; commercial general liability / property, and commercial automobile.

Fast forward thirty years and now an insurance professional, I have a better understanding of the repercussions from the climax of Ghostbusters (1984).

The Commercial Auto Policy

When applying for commercial automobile insurance, there are a few main variables to consider. This policy will be IRCA (Individually rated commercial automobile) as opposed to fleet rated since there is only one vehicle to insure.

The vehicle

The main thing we need to sort out here is the value of the vehicle to establish Rate Groups. Ecto-1 is a highly modified, 1959 Cadillac Miller-Meteor Hearse, likely powered by a 390 cu in (6.4 L) OHV V8 and a 4-speed Hydramatic automatic transmission, putting out approximately 325 HP.

if you own one of these that is currently not in use, check out our Vintage Cars Insurance page for a quote.

The vehicle was originally purchased by Ray for $4,800, shortly after he added a third mortgage to the home his parents left him. We know that when it was purchased it was likely over-priced (based on Peter’s reaction) and needed a considerable amount of work (suspension work, shocks, brakes, brake pads, lining, steering box, transmission, rear end, new rings, mufflers, a little wiring).

We also know that once the vehicle was restored, Egon added Ghostbusting technology to the roof rack, including muon scrubbers, radio GPS locator, EMF scrubbers and high-intensity micro-foam. Service lighting, decals and other interior modifications were also made to the vehicle to allow for more efficient use by the Ghostbusters.

With all of these additions and the complete restoration of the vehicle, lets assign a value of $100,000 (I have no idea as to the current costs if the EMF and muon scrubbers).

The curb weight of the Miller Meteor was approximately 3 US tons, 2,721 KG or 6,000 pounds. With the above noted modifications the weight of Ecto-1 ends up at approximately 7,300 lbs, within the limit of what is considered a ‘light’ commercial vehicle by insurance industry standards.

The Drivers

As far as we can see, Ecto-1 is principally operated by either Ray or Winston. I am a strong believer of Winston’s driving ability, not so much in Ray’s. Either way, I do believe both to have clean driving records and experience operating a vehicle in a similar class as Ecto-1, so let’s give them the maximum rating – 3 to 5 star, depending on the insurance company we are dealing with.

We will still need to assign Peter and Egon as drivers as they are also employees and may occasionally pick up the keys.

The Usage

While the GB’s drive around New York City like they are an emergency service, the specific occurrences they are responding to are rarely emergencies.

The Ghostbusters could be considered contractors, similar to pest removal companies. (“No we’re exterminators, someone saw a cockroach up on 12”). In Ontario, we would generally assign a class 36 to this type of risk. A question arises out of the vehicle weight, with the curb weight of the Miller Meteor sitting at approximately 2,700 KG. If you add on the additional weight created by the rooftop accessories, the GVW will be very close to the 4,500 KG that differentiates a heavy vehicle (class 44) from a light (class 36).

We are led to believe that the paranormal phenomena are occurring almost exclusively in New York City, but Winston does mention that they were sued by ‘every state, county and city agency in New York’. Using this information and the address of their Headquarters (14 N Moore Street, New York New York), we can determine that their radius of operations was likely over 100 miles. Let’s keep it there and not go beyond 160 km.

We will rate the Ecto-1 as a class 36, and for a territory in the GTA.

The Coverage

Liability

We are living in an increasingly litigious society in Canada. Where $2,000,000 limits used to be the ‘norm’, we recommend higher limits for all drivers in Ontario. The premium increase to $5,000,000 is minimal, so let’s recommend a minimum of a $5,000,000 liability limit. In some circumstances, they may require this limit on their automobile policy to satisfy requirements when performing work for municipalities or other corporations as well.

It is important to note that this limit may still not provide enough coverage and we recommend this as a minimum.

Optional Physical Damage Coverage

Since the build of Ecto-1 was largely completed by the team, it seems reasonable that they could make small repairs themselves. In many cases, they may be the only ones able to make the repairs. Recommending All Perils coverage with a $5,000 deductible.

Accident Benefits

Given that there are most often four occupants riding in Ecto-1, carrying standard accident benefits coverage would not be adequate. There is a high likelihood that any one of the occupants may be injured at any time during their daily ghostbusting activities. We recommended increasing the non-catastrophic injury to the maximum of $1,000,000, as well as the catastrophic injury to the maximum of $2,000,000.

Having the caregiver, housekeeping and home maintenance expense benefit increased to include non-catastrophic injuries could provide additional assistance around the station to clean and tidy up while the other non-injured members are out busting ghosts. Since the business they run is unique and they can only produce an income while they are in the field, it is recommended that we increase the income replacement up to the maximum of $1,000 per week. Death and Funeral benefits would be highly recommended, as there are several times where their lives are directly on the line while facing the likes of Gozer, Vigo and any other powerful entities.

The last coverage to include would be offset tort deductible.

Endorsements

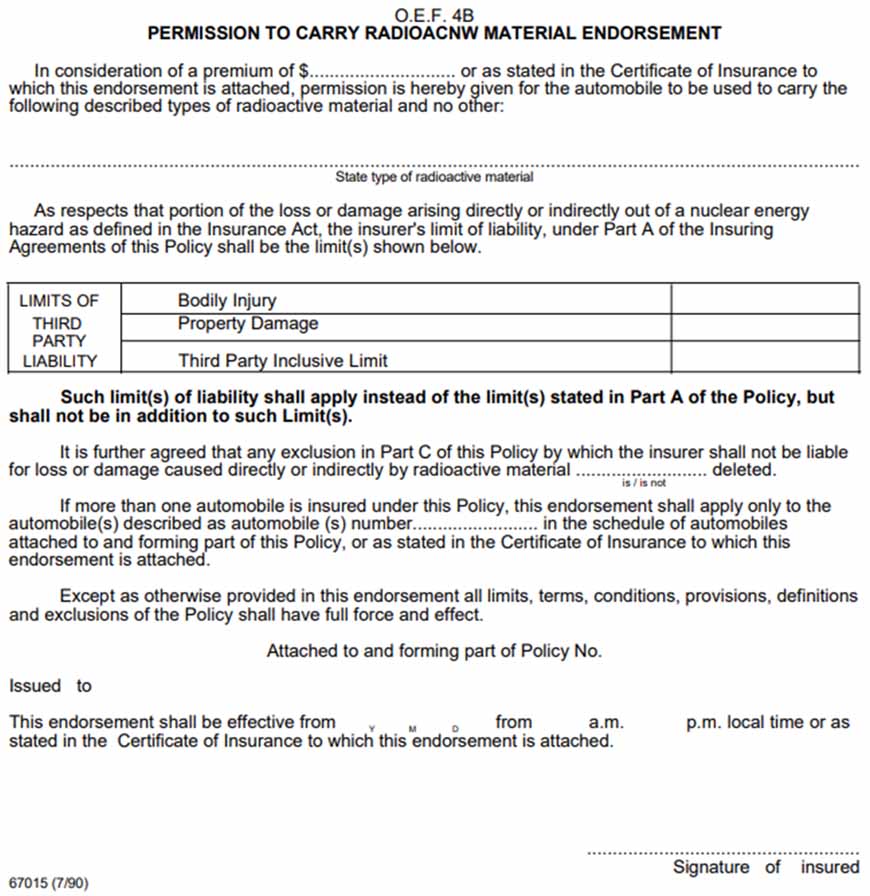

OEF 4B – Permission to carry radioactive materials endorsement.

Most commonly applied to policies for surveyors to carry a nuclear densometer to measure soil density, this endorsement is added to permit the transportation of the Proton Packs and possibly the PKE metre, Giga metre and other equipment that may contain trace elements of radioactive materials.

The exclusion for losses from radioactive material is removed from both part A (liability) and part C (physical damage) of the automobile policy.

Click to enlarge

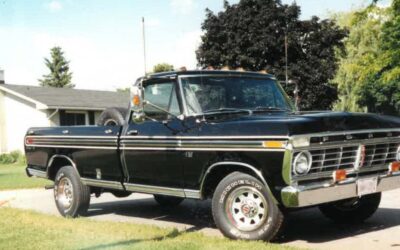

OPCF 20 / 27 – Loss of use, Liability for Damage to Non-Owned Automobiles

Extermination of poltergeists doesn’t end when Ecto-1 is an automobile accident. In Ghostbusters (1984), the team does not have a transportation alternative to Ecto-1. This endorsement should be carried to provide them with a pick-up truck or other means of transportation to allow them to continue with their work while the described automobile is being repaired.

The addition of the OPCF 27 makes sure they don’t need to purchase additional coverage from the rental car company.

OEF 30 – Excluding operation of attached equipment

The exposure from the operations of the muon scrubbers, radio GPS locator, EMF scrubbers and high-intensity micro-foam will need to be excluded on the automobile policy and picked up on the commercial general liability policy. We will expand on this in a later blog.

OPCF 44 – Family Protection Coverage

Since you aren’t sure what liability limits a third party carries, this endorsement allows you eliminate that unknown. We are recommending $5,000,000 liability limit and adding the OPCF 44, so you are protected up to $5,000,000 in a case where another driver is at-fault but does not have insurance or does not carry adequate limits.

Having a commercial automobile policy in place with limits and coverage as recommended would not have changed their situation between Ghostbusters (1984) & Ghostbusters 2 since the losses caused by the team did not result out of the operation of Ecto-1. The automobile policy is a way to protect them from suffering further financial loss from an automobile accident.

In next months blog, we will review how a Commercial General Liability / Property policy would have helped mitigate the impact of the lawsuits brought against them, as well as the financial hardships of having their own property damaged.

Jeremy Matheson & Matthew Fleming