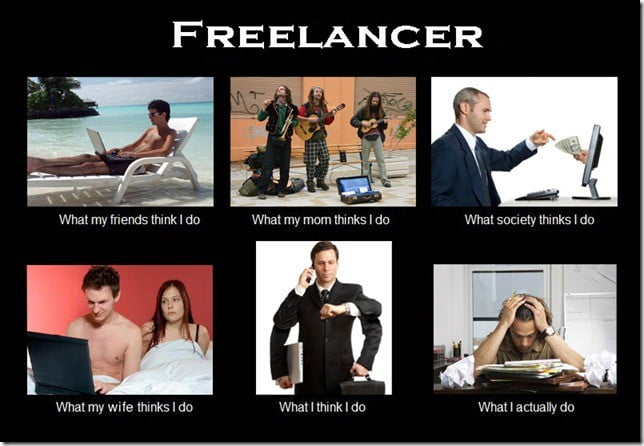

If you’re a freelancer the above meme might strike true to you. For over a year I lived with a freelance graphic designer. Never did I hear him say that his work was easy. This was also emphasized based on his many sleepless nights trying to accommodate every possible permutation of a graphic for his clients.

Not to go too far into this tangent, bottom line is that you work hard and your insurance policy should do the same.

For so many Ontarians, freelancing provides the flexibility of being your own boss. Possibly this freedom helps to explain why freelance employees are growing at twice the rate of more traditional sectors according to Statscan.

However, the flexibility alone doesn’t provide the whole answer on this growing employment sector. My friend and roommate didn’t take a 4 year university degree in graphic design. His freelance career was spawned out of his hobby. Turning his passion into his paycheque. While I could be totally wrong about this assessment, I believe it to be true.

Someone who chooses the freelance career path has a passion which cannot be filled in a traditional office. And that’s awesome!

What you may not consider, as my roommate also did not, was the legal implications of being self-employed. Those who are self-employed carry a liability risk which can rise out of a variety of reasons. Since you are your own company (or sole-proprietorship), you are not protected by another business insurance policy – so you should carry your own.

This guide is an overview covering the unique business insurance needs of freelancers and self-employed workers. We will cover important polices for the professional freelancer, how your insurance policy can provide you with a competitive advantage in the freelance marketplace, and what insurance costs can be written off against your revenue.

Building an Insurance Protection Policy for Freelancers

Commercial General Liability(CGL) Insurance

A CGL is the building block of any insurance policy. This liability policy will cover your business endeavours for common lawsuits as well as your business property. If you are looking to work from home, you may have an easier time finding house insurance by carrying a CGL.

Or if you are looking to rent an office be it a dedicated space or a collaboration workspace, it may be a requirement to carry CGL coverage in your lease agreement.

Commercial Property Insurance

If you’ve got an expensive camera for your photography business or a marketing display for tradeshows you attend then you have commercial property. Commercial property is not covered under any other policy except for your commercial insurance policy. Without proper coverage any loss or damage for any reason would not be covered.

Professional Liability Insurance

Many freelancers, such as web designers or accountants, provide professional services. If a customer suffers financial or reputational loss due to your services and hands you with a lawsuit, it will be covered under professional liability insurance – also known as errors and omissions insurance.

Errors and omissions coverage will provide your freelance business with protection of negligence in your professional capacity.

Most importantly, errors and omissions will provide coverage of defense against any actions brought against you. Just because it is a baseless lawsuit, doesn’t mean that a defense isn’t necessary and the associated costs don’t build up.

Cyber Liability Insurance

Cyber risk has taken the insurance spotlight lately – and for good reason. New methods of obtaining personal information or stealing from online businesses are being developed everyday. As a freelancer, it is likely that you submit invoices and collect payments electronically. With Canada’s new PIPEDA notification legislature passing last year, the duty and cost of notification is non-negotiable.

Selecting a broad cyber insurance policy which adapts to new and emerging cyber risks is becoming more and more important.

A comprehensive cyber insurance policy can extend to provide protection against social engineering. The act of a criminal posing as a legitimate customer or vendor requesting you send them money.

Cyber insurance policies also come with a whole team of experts there to help you when a hack or breach occurs. Your policy can respond with recovery in the same way as repairing your home or vehicle. Finding out what was taken, how your computer was breached, and what your next steps should be is an invaluable service. Picking up the pieces after a breach can be a dizzying exercise if you don’t know where to start but with the help of professionals who put systems back together everyday it will be a much easier and quicker process for you.

Commercial Auto Insurance

If you utilize your vehicle to make deliveries or carry your tools, then your personal auto insurance may be deemed void. Those and other types of commercial uses are beyond the scope of coverage which a personal auto policy has agreed to. Sometimes, a commercial auto policy can end up being cheaper while providing broader & specialized coverage.

Bonds

A bond is a three-party agreement between your business, your client, and the insurance company. The bond will pay your client if you fail to provide completion of your business contracts as promised. If you are a freelance IT professional, working in construction, or even cleaning services, then your clients may insist you purchase a bond. More importantly, your commercial liability policy would not provide payment for the repair or replacement of faulty work – your bond policy can be called on in this case.

Giving You the Competitive Edge Through Insurance

It’s natural that when a company or prospective client is looking to hire the services of a professional freelancer, they would like to see that you are fully insured. When quoting a job against someone who doesn’t carry an insurance policy the prospect may lean towards those with the most protection.

Your client is only trying to protect themselves – accidents happen. For example, if a retailer hires you as a web developer to create an e-commerce store for them and your project is delayed causing your client loss of revenue or even reputational harm, your professional liability policy will provide coverage for your client’s loss up to your policy limits.

Providing your prospective clients with the peace of mind that you carry insurance could be the difference between landing a job or not.

You Work Hard for Your Money – Here’s How to Save on Insurance Premium

Even though it is important to carry adequate insurance coverage, I don’t want you to be insurance poor. There are ways to reduce your insurance costs while keeping yourself and your business protected.

Bundle insurance coverage

By carrying all of your insurance policies with the same insurer, you will receive additional discounts. If you’ve got a general liability policy and a commercial auto policy with the same insurer, be sure that you are receiving all the cross-policy discounts you are entitled to.

Carry a high deductible

Insurance coverage is here for events that will change your life. If you can self-insure to $5,000 rather than $500, you are going to save big on your insurance premium. In fact, most insurers will surcharge your premium if a deductible under $1,000 is carried! If you’re a photographer with a multitude of cameras, if they are all stolen or they are all damaged by water that could result in huge costs to you. However, can you afford to replace one? If so, increase your deductible and save on your premium.

Paying your premium in full

Standard financing fees in Ontario are 3% for a property insurance policy and 1.3% for an auto policy. However, it is charged on the entire premium. Not on a declining balance like an interest payment. On a property insurance policy this ends up being like paying 9% interest on your insurance premium. If you can afford to pay it at once, or borrow money at a lower interest rate, then pay your premium in full.

Work with an Insurance Broker

An insurance broker is going to shop your policy based on your specific needs with a multitude to insurance companies. An insurance broker is also going to point out important differences between quotations provided from those insurance companies.

Your insurance broker should also be reviewing your policy annually. Making sure that as your business changes, your insurance policy changes with you.

If you haven’t heard from your insurance broker in a while, call and chat with one of ours.

Deducting Business Insurance from Your Taxes

To get the full list of eligible expenses which can be written off, check out the Business Expenses page of the Government of Canada.

For your commercial property policies, you can deduct all ordinary insurance expenses incurred on any buildings, machinery, or equipment that you use for your business.

You cannot write off the liability portion of your policy however, for example, if you are an accountant who relies on your computer to work you can write off the costs of insuring that piece of equipment. Or if you are a welding contactor, you can write off the expense of insuring all of your welding equipment.

Protect Your Future and Your Business

Insurance will provide you with protection for the future of your business. Rather than worrying about potential lawsuits or unrecoverable property losses you can focus on landing more clients!

If you still have questions about business insurance please reach out to one of our brokers for additional consultation and guidance.